|

Check out our new audio content!

Getting your Trinity Audio player ready...

|

By Victoria Kennedy

An important caveat to real estate investment, quite simply, it’s expensive. It requires more capital upfront to get going, and for a lot of potential investors, it just isn’t feasible. But Victor Cuevas, founder of Griffin Crowd and Capital, just might have the answer, and it’s a surprising, but innovative one. He suggests using crowdfunding!

When we typically think of investments, the stock market comes to mind. However, real estate is emerging as a competitive alternative to stocks, one that is safer and can often yield higher returns. But like so much else in business, real estate investments lead to portfolio diversity.

“Borrowers using a crowdfunding portal have an advantage because they can get funds from a wider pool of investors,” said Cuevas. “While they typically have to accept a higher interest rate in order to get additional funds, the access to those additional investors is typically worth it.”

Whatever side of the fence you are currently on, as either a borrower or investor, see below for a few tips from Cuevas to get you started.

Learn about Splitting the Bill

Image from Pixabay

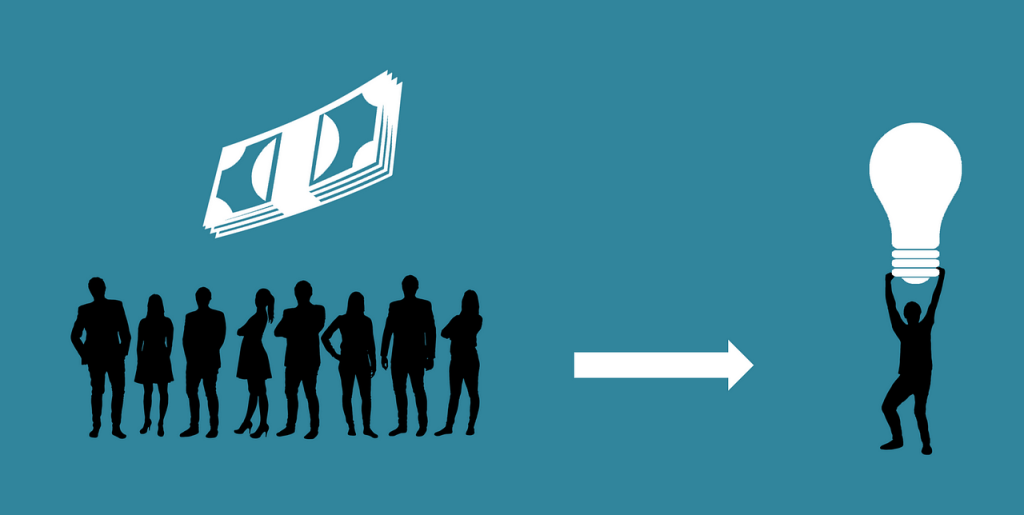

As it turns out, investing in real estate may not be as costly as it seems. With the rising popularity of crowdfunding—online platforms for sourcing capital for a given project—a creative new approach has emerged for breaking into the prohibitively expensive, but wildly lucrative field of real estate investment. With a little help from crowdfunding, you could soon be on your way to making big bucks, while at the same time, shaking things up along the way. Cuevas recommends crowdfunding as a way to expand your possibilities and adapt to the rising cost of homes. In the past year alone, Griffin Crowd and Capital has crowdfunded over 100 residential apartment complexes totaling tens of millions in profit as a result.

Find Strength in Numbers

David and Goliath was a close one, but ultimately, the “little guy” triumphed by sheer ingenuity. Now imagine if it had been 10 Davids, all equally resourceful, taking on that single Goliath—it would almost be unfair. And that’s the idea here.

Cuevas recommends using crowdfunding as a way of teaming up and pooling resources to collectively achieve what is too often reserved for the already-wealthy. It is a great way to challenge the longstanding dynamic of the “fat cat” being the one at the top.

A Man’s Game? Don’t be So Sure

Any number of factors can explain the demographic disparity of real estate investment, and investment in general. From systemic and interpersonal sexism and racism, to toxic notions surrounding women and investment in general, there’s no question: it’s an uphill battle for women and minority investors.

But one thing is for sure, regardless of this inadequate representation, there’s zero truth to any notion that non-male, individuals are in any way, shape, or form “less fit” for the field—the truth is, there’s just more to work against. While this may seem so obvious, nevertheless, the myths floating around can still be damaging. The key is to try not to be dissuaded by all these ‘tall tales’—you know what you’re capable of. As Cuevas said, “it’s a fast-growing market” and now is the best time to get involved!

Learn Where to Invest Sensibly

Image from Pixabay

Real estate is a huge field encapsulating all sorts of different sub-categories within it. If you’re seeking to maximize your returns all while keeping your overhead to a minimum, Cuevas recommends looking at multi-family residentials. These have emerged as popular living arrangements, and they’re generally cheaper and easier to invest in than larger properties. Between collecting rent and easier mortgage terms, there are numerous advantages that should put the multi-family residential towards the very top of your list when it comes to prospective real estate investments.

Pick a Winner: Choose the Right Bank

Image from Pixabay

When investing in real estate, it’s essential to choose a bank that’s a good fit for your investments. Cuevas suggests paying close attention to the experience and track record of the institutions you consider. It’s important to be certain that the bank you go with has enough experience in the area you’re investing in to best assist your specific needs. For example, at Griffin Crowd and Capital, Cuevas puts his 30-plus years of specific experience in the field at the disposal of his clients—all the knowledge, know-how, and vital industry connections go into helping clients ensure the maximum possible return on their investments.

It can be a daunting prospect, but with the right approach, investing could become your next successful venture. With crowdfunding, it doesn’t have to cost an arm and a leg, and by focusing on real estate, particularly multi-family residentials, you can start generating wealth easily and with little risk. While there may indeed be some obstacles standing in your way, with the help of creative solutions, careful planning, and a little teamwork, it might not be such a distant dream.

About Victor Cuevas

Victor Cuevas is an industry professional with over 30 years of mortgage finance experience, including extensive knowledge in both residential and commercial properties. He is a successful serial entrepreneur with a multitude of accomplished companies and ventures. Among them, Victor built a mortgage empire, spanning 36 offices in several western and central states. He currently serves as the founder of Griffin Crowd & Capital, the next chapter in an already illustrious career. For more information, visit griffincrowdcapital.com