|

Check out our new audio content!

Getting your Trinity Audio player ready...

|

Image from Pexels

By Bruce Kellogg

Why Caveat Investor?

There have been many changes in real estate since the boom began in 2010 after the Great Recession. To name a few: 1) Real estate licensees have increased about 40%. 2) Syndicators are gobbling up apartments, self-storage, mobile home parks, and industrial warehouses. 3) Brokerage companies are paying cash and “flipping” houses using venture capitalists’ money. 4) Brokerages are hiring agents like employees with salaries, vacations, health insurance, retirement plans, and stock options. 5) Developers are building whole communities of houses for rent. There’s a lot more, of course, but no time to exhaust the subject.

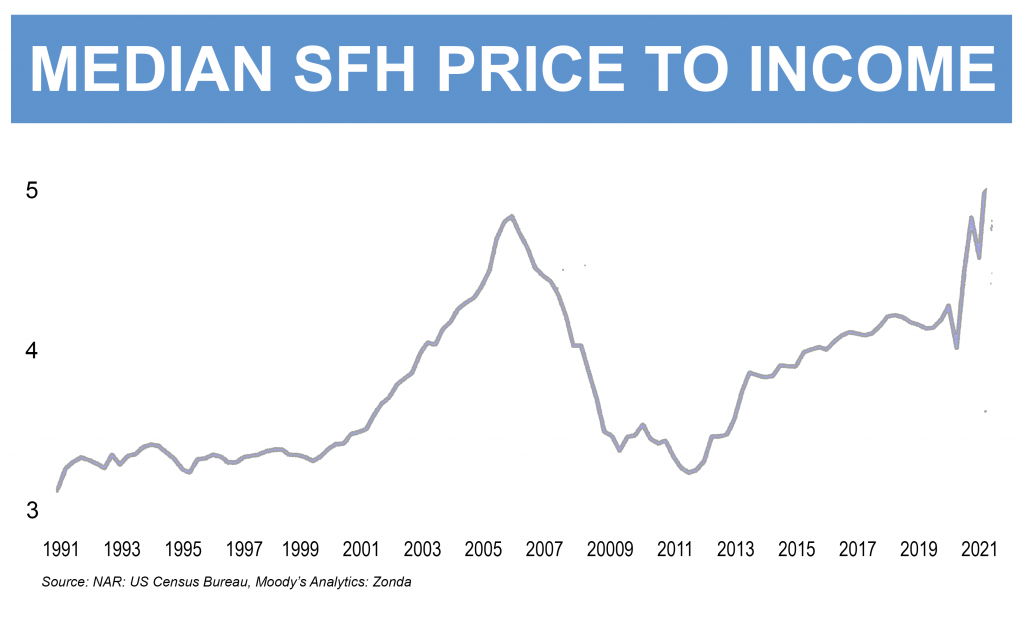

See the accompanying chart. Markets appear to be in the late stage of their up-cycle. As always, change is coming.

This article is my survey of many aspects of real estate where readers and investors need to be cautious and diligent in this expansive and innovative real estate environment. Every effort was made to address the major places where investors could get cheated or financially hurt in other ways. So, here goes.

#1 – Homebuying

Many homebuyers are making offers without inspection contingencies in an attempt to win in competitive bidding. The same is true of “as is” purchasing. Buyers are also not scrutinizing property condition disclosures from sellers. All of this is risky and imprudent. Deal with this as best you can. You can always walk.

#2 – Brokers and Agents

Reportedly, 40% of the new agents in California were licensed only in the past two years. (Other places are probably similar.) The average agent does 3-4 deals per year, so they might have 8 transactions under their belt. These are beginners, or novices, even though their business card might have “senior” in their title. “Junior or apprentice” would be more like it. Pick an agent with 10 years or more of full-time experience, and over 6o closed transactions, primarily with the type of property you are working with. Hire a pro.

Image from Pixabay

The other thing you need to watch out for is agent/brokers exaggerating their accomplishments and/or qualifications. I saw a flyer recently where a pair of new agents boasted of selling 250+ listings worth $250+ million. What they had done is taken the whole company’s production and taken credit for it. Brokers and sales managers are supposed to review and approve all agent advertising, but they don’t. So protect yourself. Be skeptical of “puff” in the advertising you receive. Or ask for proof, if there is any.

#3 – Syndications

There are a lot of trainers and ”gurus” traversing the countryside teaching how to do syndications. The attraction is that you can quit your job and become wealthy. They present testimonials, picture luxury homes, and stand next to exotic automobiles. So, a lot of sincere but inexperienced people sign up. Lately, there is a huge demand for apartments by syndications that might overpay, buy wrong properties, or mismanage the 5-7-10 year project. It’s easy to make faulty or fraudulent projections on a 10-year EXCEL spreadsheet.

The other thing is that new syndicators are taught to pay experienced syndicators with good credentials to lend their qualifications to the project for a portion of the ownership. This makes the new syndicator look better. But are they really better, or still inexperienced beginners? Would you bet your money?

#4 – Turnkey Investing

Image from Pixabay

Distance investing in “turnkey” properties can be viable if it is done right. Needed are a rehab with quality materials, all necessary inspections, and all permits signed off. Many turnkey operators skimp on these to increase their profits. A prudent investor would visit the area, inspect the property, review the inspections and permits, and interview the potential property manager. “Armchair investing” is not enough because once you buy, it’s yours. The others could split, and you’re on your own.

I had a client who wasn’t given promised repairs. The city inspected and threatened to prosecute him in Cleveland while he lives in Palo Alto, California. He fired the do-nothing property manager, hired a new one, got the repairs done, and salvaged his situation. It’s a quality, brick home in a good area with a quality tenant and good cash flow, but a “passive investment” it was not.

#5 – Fix & Flips

Image from Pixabay

Much of the talk on TV, in the media, and online is about “fix & flips” of houses, and even larger properties. Every now and then the news reports the average profit is $60,000+ per flip. You can do one every six months, part-time! Really? Well, the $60K “profit” is not calculated to include materials, labor, permits, advertising, and holding costs. Big difference! Perhaps this is why 80% of “fix & flip” entrepreneurs reportedly quit after their first project.

Now, if you want to try it, do it right. 1) Estimate the costs accurately. 2) Estimate the “After-Repaired Value” (ARV) accurately. 3) Hire a competent, reliable contractor. 4) Select the right type of house. No two bedrooms. Too small. No Victorians. Antique money pits! (Disclosure: I live in one, built in 1898.) Ideal are 3-5 bedroom, modern-construction “tract” homes on standard city lots, bought right. Do not compromise and “reach for a deal”. Pass, and keep looking. As they say, “You make your profit when you buy.”

Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor for 40 years. He has transacted about 800 properties in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches.

He writes and edits copy for Realty411 and REI Wealth Monthly magazines.

Mr. Kellogg is a recipient of an Albert Nelson Marquis Lifetime Achievement Award, listed in Who’s Who in America – 2019.

Mr. Kellogg is available for consulting about syndication, “turnkey” investments, joint-ventures, and other property purchases nationally, and other consulting assignments. Reach him at [email protected], or (408) 489-0131.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.