|

Check out our new audio content!

Getting your Trinity Audio player ready...

|

Image from Pixabay

Experts share tips for drafting effective real estate succession plan

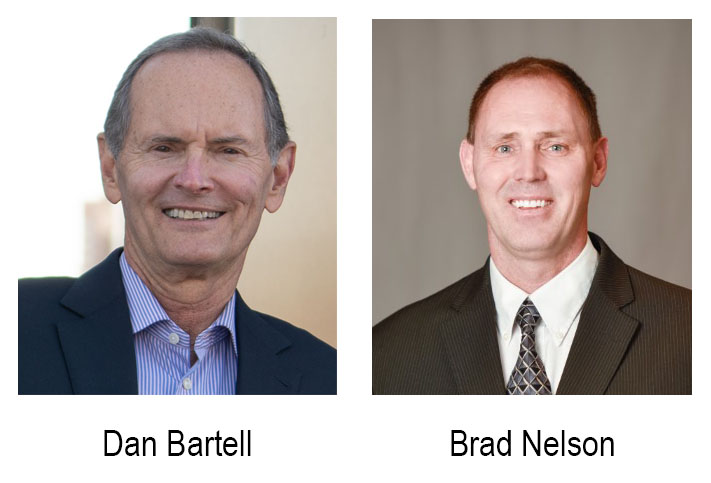

By Brad Nelson, Senior Real Estate Asset Manager, BOK Financial & Dan Bartell, president of Bartell and Company Real Estate Wealth Management

Ensuring those who inherit your real estate property don’t inherit a headache means having a plan in place. A real estate succession plan is one piece of a bigger estate planning strategy, as it helps protect assets, maintains or increases cash-flow for future generations, and yields more effective and flexible tax strategies. A real estate succession plan plays an important part in helping you achieve your goals and investment objectives.

If someone passes away without a succession blueprint in place, things like what to do with inherited real estate are left to chance.

Image from Pixabay

Many times, family members who inherit real estate want to sell it before they even know what they have. They typically don’t have the expertise to take on the role of a real estate professional who can help them evaluate the assets. Without the real estate expertise, the beneficiaries default into selling the assets without knowing the potential value of what they have inherited. In many cases real estate property may be re-developed into something bigger or more valuable than the original zoning, all of which would/could make it a more favorable investment. Having a plan in place can also help eliminate unnecessary and unexpected family conflict that arises from an under-qualified individual being left to manage the asset.

When it comes to the creation of a real estate succession plan, we suggest keeping a few things in mind.

Analyze family conditions

This analysis involves taking a thorough look at family dynamics and the individual relationships. It also takes into account stages of life of stakeholders, which can have an impact on the members’ needs and how the plan moves forward. This step involves determining to whom, and how, the asset will be transferred, and who will be managing the real estate assets, and establishing goals and objectives.

Image from Pixabay

In each case it’s important to consider if those being named as inheritors or managers are qualified to manage this type of asset. Do they have the appropriate licenses, maturity and experiences? Could this cause additional contention or division amongst other family members? These are important questions to ask at this phase.

The ages of everyone involved also matters. Their season of life will affect the lens they use to view things like assets and income, so these are important considerations to keep in mind. As an analogy, an aging parent who has a long history of successful real estate experience may want to keep their feet in the investment world without too much personal involvement, and without subjecting his/her children to undue risk. However, the children who view growing market conditions in their area might want to push the envelope and do more within an established strategy.

The parent and the children are seeing the situation from different walks of life, with different goals and experiences. There are ways to help the two generations find common ground and share in appropriate risk and potential reward, rather than investing and developing simply because they can.

Have frank discussions

Having frank discussions is where people tend to struggle the most. Sometimes people are reluctant, but it is important to have honest and open conversations with your estate attorney and wealth management advisor regarding the future of the family. It’s best to be open about goals and obstacles that could arise down the road.

Image from Pixabay

Knee-jerk responses to dramatic life events can yield irrational investment behavior. Making assumptions about an individual’s intrinsic motivation and perception of the situation can yield drastically negative results. Asking the parties not only what they need out of the real estate, but also why having the real estate itself is meaningful, is sometimes difficult—but often cathartic. Asking this type of question smooths the course, maintains positive relationships, and often has a positive impact on the health of the investment.

Evaluate the asset’s performance

People don’t always take the time to look closely at a real estate asset and evaluate if it’s performing as well as it can and how it reacts to different circumstances. Partnerwith a real estate professional to have an analytics report completed on the asset to understand past, present and future forecasting performance.

The performance analysis should include the following:

- Investment objectives

- Historical performance as compared to the market/submarket

- Debt service coverage analysis

- Asset basis

- Cash on cash returns

- Current condition of property

- Internal rate of return

- Cash flow

- Cash reserve analysis

The analysis should focus on the strategies that can be implemented to maximize cash flow while adding value, as well determining if the asset is underutilized or underperforming.

Image from Pixabay

Understand the risk

It’s important to get a full understanding of the different elements that make up your real estate and how they might perform in the context of today’s world, while considering future uncertainties and risks.

In working to understand the risk, there are some additional key questions to consider:

- Are there any environmental issues?

- How is the asset currently titled?

- Has an insurance valuation been performed to ensure adequate coverage?

- Are the returns acceptable as it relates to the overall risk?

When it comes to a real estate succession plan, or an estate plan, it isn’t one and done. Family dynamics, situations and values change, and will need to be re-visited along with those ongoing conversations.